You have questions . . . we have answers. Browse through some of our most commonly asked questions or contact us for additional information.

An employer can be assessed a fine of $1,000 per affected individual where the employer or carrier willfully fails to provide an SBC. Other penalties can include a $100 per day, per affected person fine issued by the Department of Labor or Health and Human Services. PHP will be held harmless from all costs associated if you fail to distribute the SBCs as required by the ACA or other applicable regulations. If PHP is fined in relation to the employer’s failure to abide by any SBC legal requirements, the employer will be liable to reimburse PHP for any resulting fines and/or penalties.

Before PHP can revise any SBCs for distribution by the employer group, the group must provide adequate advanced notification to PHP if there will be a change to benefits.

**Members must receive an updated SBC 60 days in advance of any changes to their benefit plan.**

At the times required by the Affordable Care Act (ACA), including:

- Initial enrollment - at new group implementation and to new hires throughout the year

- Open enrollment - immediately upon confirmation of group’s plan decision for renewal

The Employer Group is responsible for sending SBCs, either in paper or electronic format, to its employees, participants and beneficiaries. PHP will create the SBCs so that the employer can distribute SBCs to such individuals in a timely manner.

Current SBCs are available online at www.phpni.com, on the Employer Portal under the Benefits/Contract tab.

Upon application - If a plan (including a self-insured group health plan) or an issuer distributes written application materials for enrollment, the SBC must be provided as part of those materials. For this purpose, written application materials include any forms or requests for information, in paper form or through a website or email, that must be completed for enrollment.

By first day of coverage - If there is any change in the information required to be in the SBC that was provided upon application and before the first day of coverage, the plan or issuer must update and provide a current SBC no later than the first day of coverage.

Special enrollment/enrollees - The SBC must be provided to special enrollees no later than the date on which a summary plan description is required to be provided (90 days from enrollment). A special enrollee is an eligible person who did not enroll during their open enrollment period, or a person who acquired a new dependent through marriage, birth or adoption.

Upon renewal - If a plan or issuer requires participants and beneficiaries to actively elect to maintain coverage during an open season, or provides them with the opportunity to change coverage options in an open season, the plan or issuer must provide the SBC at the same time it distributes open season materials.

Upon request - The SBC must be provided upon request for an SBC or summary information about the health coverage as soon as practicable but in no event later than seven business days following receipt of the request.

PHP is responsible for creating and delivering the SBC to the Employer Group, at no additional cost to members at renewal or for any mid-year plan change. For self-funded groups, the responsibility of creating the SBCs lies with the employer.

A short, easy-to-understand document provided to consumers that summarizes the key features of the plan or coverage they are considering or that they currently have. Think of it as the “Nutrition Facts” label of the health insurance industry.

In order to determine the feasibility of coverage for special employment situations, the following steps will apply:

- Contact your Account Manager

- Provide the details of the situation.

- Upon Underwriting approval, your Account Manager will work with you to determine the most appropriate network for the employee.

If an employee is age 65 or over and covered by a group health plan because of current employment or the current employment of a spouse of any age, Medicare is the secondary payer if the employer has 20 or more employees and covers any of the same services as Medicare. This means that the group health plan is the primary payer. The group health plan pays first on your hospital and medical bills. If the group health plan did not pay the entire bill, the provider should submit the bill to Medicare for secondary payment. Medicare will review what your group health plan paid for Medicare-covered health care services and pay any additional costs up to the Medicare-approved amount. The employee will be responsible for the costs of services that Medicare or the group health plan does not cover. If the employer has less than 20 employees, Medicare is primary.

The effective date for a returning or rehired employee will be determined by the employer’s group contract.

The effective date of coverage for part-time employees changing to full-time status is determined by the Employer’s Group Contract. Please refer to your Application for Group Contract.

When an employee is ordered to enroll himself/herself and/or a dependent child through a QMCSO, coverage shall be effective on the date the order is determined to be a QMCSO. We must receive a copy of the QMCSO and an Enrollment Form or Change Form to enroll the employee and/or the child.

If an employee or dependent does not enroll in the plan at the time they are first eligible, they may be eligible to come on the plan other than during open enrollment if:

- A new dependent is acquired due to marriage, birth or adoption, or

- An eligible employee or dependent was covered under another health plan and involuntarily loses coverage.

Refer to the Special Enrollment section of your contract for more information pertaining to special enrollment privileges under HIPAA.

An unmarried dependent child may continue on the plan beyond the dependent limiting age if:

- The child is incapable of self-sustaining employment due to mental or physical disabilities,

- The child is primarily reliant on the employee for support and maintenance,

- Proof of incapacity and dependency is given to PHP within 120 days of reaching the limiting age, and

- The child remains incapacitated and dependent, unless coverage otherwise ends under the contract.

Continued incapacity and dependency may be periodically verified at PHP’s discretion.

- The Subscriber’s legal spouse;

- A child who is under 26 years of age and a United States citizen or legal resident of the United States and:

- A son or daughter of the Subscriber regardless of support level; or

- A step-child, child subject to legal guardianship, grandchild or other blood relative who depends on the Subscriber for more than 50% of total support;

- Any child of the Subscriber who is recognized under a Qualified Medical Child Support Order (QMCSO) as having a right to enroll under the Contract.

PHP is not a COBRA advisor, nor do we provide advice on this subject. However, federal guidelines state the following: “All employers who had 20 or more employees on 50% of their typical business day during the preceding calendar year MUST comply with COBRA. The only exceptions to this rule are: Federal Government and Church Plans (within the meaning of Section 414 (e) of the Internal Revenue Code.)”

Open Enrollment is the period of time (usually one month prior to the group’s renewal) that is listed on the group contract that allows eligible employees who previously did not enroll, to come onto the plan and for those members enrolled to add, delete and/or make changes to their current coverage.

Credible Certificate of Coverage is required to prove prior coverage during a Qualifying Event. (Example: An employee loses coverage through his/her employer and now wants to be covered under the spouse’s plan. The CCOC will provide date coverage ended under prior carrier.)

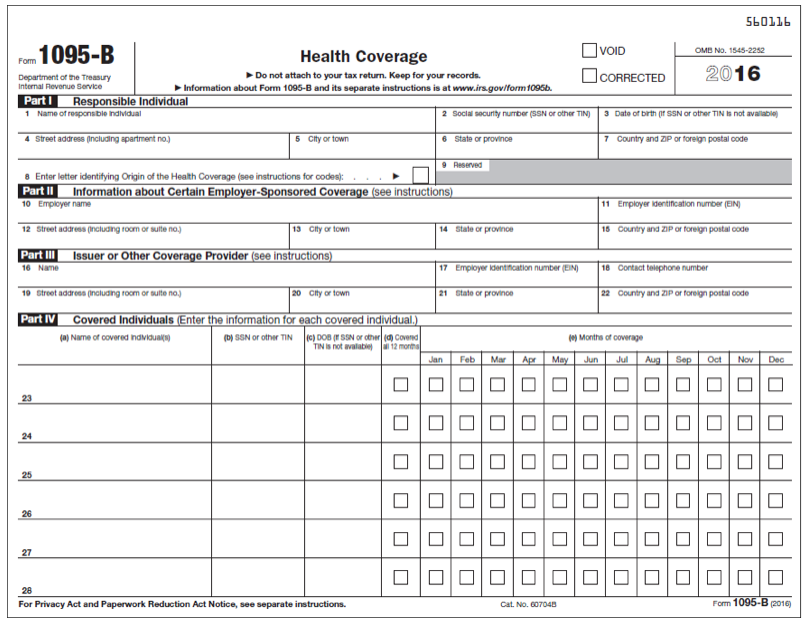

Here’s an example of Form 1095-B.

We’re sorry; PHP is not able to answer tax questions or give tax advice.

Delivery of Form 1095-B

PHP is required to deliver the form no later than March 31, 2017, however we are striving to deliver the form no later than February 20, 2017.

You need NOT wait on Form 1095-B to file your taxes!

Information on the form may help you prepare your taxes, however having the form in-hand is not required. You can use other information about your health insurance to complete your tax forms. (You must wait on Form 1095-A to file taxes; you need not wait on Form 1095-C).

No. Form 1095-B will NOT be sent to employers. Policyholders receive the form AND the Internal Revenue Service (IRS).

If you have dependents (spouse or adult child) that you do not include on your tax return, you must provide a copy of Form 1095-B to them. PHP will supply copies of the form to policyholders only.

You will receive only one form unless:

- You had insurance coverage through more than one employer in 2016.

- You had Off-Marketplace individual coverage for part of the year and through an employer for part of the year.

If your form has your Social Security Number (SSN)

Your SSN will be used to verify MEC against your tax return, so you will not need an updated form.

If the form does NOT contain your SSN and therefore cannot be verified, please contact PHP’s Customer Service Department at 260-432-6690, Extension 16. We will update the form and send you a new form with your updated name.

All fully-insured PHP group and off-Marketplace individual policyholders will receive form 1095-B.

Form 1095-A, for Marketplace coverage

For answers to questions about 1095-A, call the Marketplace at 1-800-219-7214. This form is issued by the Federal Government.

Form 1095-C, for groups with 50, or more, employees

Form 1095-C questions must be answered by employers at the phone number listed on line 10 of the form. This form is issued specifically by employers that have more than 50 employees.

Yes, ALL PHP plans meet requirements for MEC (Minimum Essential Coverage). (For a detailed description of MEC, go to: https://www.irs.gov/Affordable-Care-Act/ Questions-and-Answers-on-Information-Reporting-by-Health-Coverage-Providers-Section-6055).

If you prepare your own taxes

Do NOT attach the form or send it with your taxes; keep it with your other important tax papers. If the form shows insurance for you and everyone listed on your tax return for the entire year, check the full-year coverage box on your tax return (located on line 61 of Form 1040, line 38 of Form 1040A or line 11 of Form 1040EZ).

If there are months when you or your family members did not have insurance you may be able to find helpful information at: https://www.irs.gov/Affordable-Care-Act/Questions-and- Answers-about-Health-Care-Information-Forms-for-Individuals. You may qualify for an exemption or you may have to make an individual shared responsibility payment.

If you don’t prepare your own taxes

Share the 1095-B form with your tax preparer. They will need this information to file your taxes properly.

As your health insurance partner, PHP is required to report insurance information (Section 6055) about you and your covered dependents (spouse and/or children) to comply with the Affordable Care Act. The ACA requires all Americans show proof of insurance (called Minimum Essential Coverage, or MEC) starting with their 2015 tax return filed in 2016, or pay a penalty unless subject to an exemption.

PHP's goal is to provide quality products and superior service. Questions about benefits, eligibility, claims payment, prior authorization, or the participation status of doctors, hospitals, or other facilities can be addressed by our Customer Service Department.

PHP Customer Service Department

260-432-6690, Extension 11

1-800-982-6257, Extension 11

260-459-2600 for the hearing impaired

custsvc@phpni.com

PHP's definition of an emergency allows coverage for emergency room services that a reasonable person would consider dangerous to the patient's life or health. If a life-threatening medical condition occurs, call 911 or your local emergency service. If a non-life-threatening emergency occurs, contact your doctor for direction.

It is a good idea to discuss with your doctor what to do in the event of an urgent medical situation before it happens.

If your card has the PHP logo and purple coloring, Physicians Health Plan is your healthcare insurance company.

If your card is black and white with your company's name, Physicians Health Plan is not your healthcare insurance company. Your employer has a self-funded health plan and is financially responsible for payment of your benefits and determines what services are covered and at what benefit level. They have selected PHP Management Systems, Inc. (PHPMSI), a Third Party Administrator and a subsidiary of Physicians Health Plan, Inc., to manage and process medical claims on their behalf. Provider network participation may vary. Please refer to your Summary Plan Description or contact PHP's Customer Service Department for details.

Physicians Health Plan provides "out of network" benefits for members enrolled in point of service benefit plans. With out of network benefits, members may use doctors and other health care providers outside of the PHP network. Payment rendered by PHP will be based on language in the member’s certificate of coverage that in most cases requires the amount to be either:

The In-Network Provider's standard rate adjusted by a geographical factor assigned to the location where the service was rendered; or

The out of network Provider's eligible billed charge.

PHP utilizes geographical factors established and used by the Centers for Medicare and Medicaid Services (CMS).

By using In Network provider rates and geographical factors, the maximum payment PHP allows for out of network claims will, at times, be less than the amount billed by a provider for a particular service. This may affect the member's out of pocket costs because the member is responsible for the difference between the out of network provider's charge and what PHP pays. This is known as Reasonable and Customary.

A referral to a non-participating doctor may be obtained if a uniquely specialized procedure is medically necessary and not performed by any participating doctors. This process must be requested by your participating doctor and approved by PHP, in writing, prior to receiving the services.

Our provider directory helps you to find a doctor or a facility. Please be aware that this information is updated on a regular basis. To be certain a doctor is participating, ask the office staff prior to receiving care, or call the PHP Customer Service Department. Always show your ID card at each visit.

Ready to find the insurance plan that best fits your business' needs? Let us get to know you with a few quick questions and a PHP Sales Representative will help you find the perfect plan.

Start NowWhen we say we're here to help, we really mean it. PHP is a no-robot zone – that means when you contact us, someone from our Indiana office will be ready and happy to assist you.

Let's talk